Roof Financing

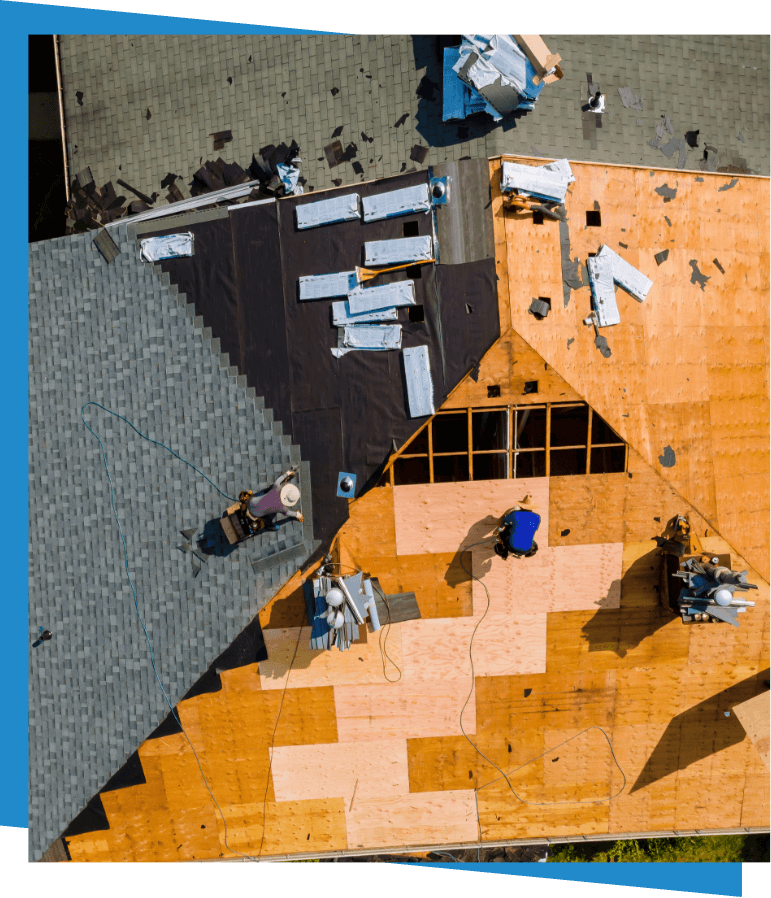

Your roof is your home’s first line of defense against the elements. But when it needs repairs or replacement, the upfront cost can feel daunting. That’s where roof financing comes in. Here, we’ll explore various financing options to make your roof project a budget-friendly reality.

Why Roof Financing Makes Sense

Unexpected roof issues can disrupt your financial plans. Financing helps you:

Prioritize essential repairs

A leaking roof can lead to costly water damage. Financing allows you to prioritize repairs without dipping into savings.

Invest in a new roof

A new roof significantly increases your home’s value and protects your belongings. Financing spreads the cost over manageable monthly payments.

Improve energy efficiency

Modern roofing materials provide superior insulation. Financing can help you upgrade to a more energy-efficient roof, potentially lowering your utility bills.

Understanding Your Roof Financing Options

Several financing options cater to different needs and credit scores. Here’s an overview of popular choices:

Home improvement loans

Offered by banks and credit unions, these unsecured loans provide a lump sum for your project. Interest rates can vary depending on your creditworthiness, but fixed rates offer predictability.

HELOC (Home Equity Line of Credit)

If you have equity in your home, a HELOC allows you to borrow against that value with a revolving credit line. Interest rates are typically adjustable, so keep an eye on market fluctuations.

Cash-out refinance

This option replaces your existing mortgage with a new one for a higher amount. You receive the difference in cash, which can be used for roof repairs or a full replacement. Consider the potential impact on your overall loan term and interest rate.

Credit card financing

While convenient, credit cards often have high interest rates. Only consider this option if you can pay off the balance quickly to avoid accruing significant debt.

Roofing contractor financing

Many roofing contractors offer in-house financing programs with flexible terms and competitive rates. These can be a good option, but compare them to other financing options before deciding.

Factors to Consider When Choosing Roof Financing

- Interest rate: The lower the interest rate, the less you’ll pay overall.

- Loan term: A shorter loan term means higher monthly payments, but you’ll pay off the loan faster and save on interest.

- Down payment: Some lenders require a down payment, which can reduce the overall loan amount and potentially lower your monthly payment.

- Fees: Be aware of any origination fees, application fees, or prepayment penalties associated with the loan.

Additional Tips for Getting the Best Roof Financing Deal

- Shop around: Compare rates, terms, and fees from multiple lenders to find the option best suited to your needs.

- Check your credit score: A good credit score will qualify you for lower interest rates. Consider improving your credit score before applying for financing.

- Get multiple estimates: Obtain quotes from several reputable roofing contractors to get a clear picture of project costs.

- Understand the fine print: Read loan agreements carefully before signing to avoid any surprises.

- Plan your budget: Factor in financing costs, insurance deductibles, and any unexpected expenses when budgeting for your roof project.

By considering these aspects, you can find roof financing that fits your budget and allows you to invest in a secure, weatherproof home. **

Peace of Mind Starts with a Secure Roof

Financing your roof project shouldn’t add unnecessary stress. With a little planning and research, you can find a payment solution that keeps your wallet happy and your home protected.

Ready to Get Started?

Contact us today for a free roof inspection. We’ll work with you to assess your roof’s condition and discuss financing options to help you achieve a safe and secure home environment.